Publications

Last

Advertisement

Partners

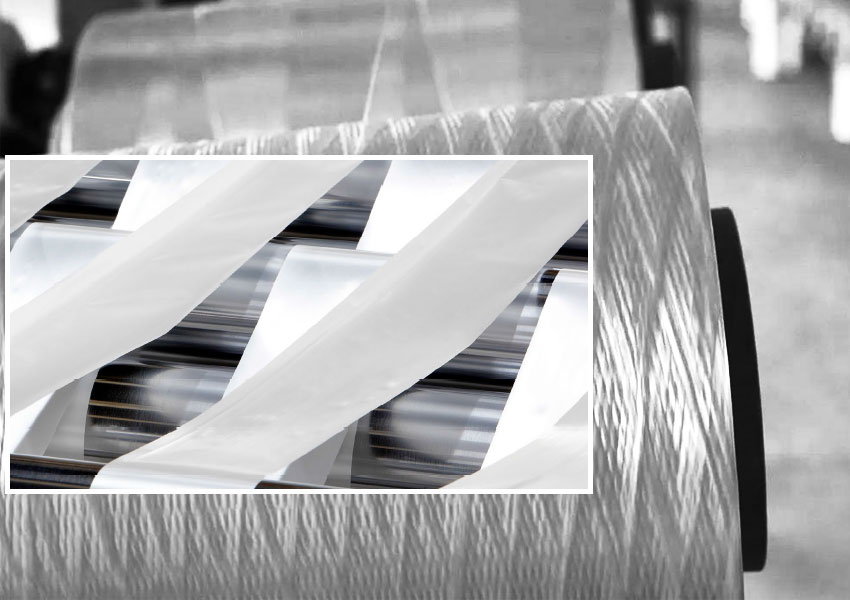

Spunmelt nonwovens market leaders: new investments and technologies

Avgol Nonwovens

In December 2022, Avgol announced that it plans to install a modern high-speed line Reicofil 5 at its facility in Moxville, North Carolina. This will be the sixth line of the company at this production site. The installation of the new line will allow the company to increase production capacity by supplying rolled materials made in America and offer more sustainable solutions in the growing North American market. The latest investments will ensure the production of biocomponent and high-loft materials for high-end products in the hygiene segment.

The last investment of Avgol in the USA was made in 2015, when the company added its fifth line "spunmelt" in North Carolina. The company also has production sites in Russia, China, Israel and India. In addition, Avgol has entered into a partnership agreement with Yan Jan USA LLC to supply perforated spunbond products manufactured by YanJan to the North American market.

Berry Global

With production centers all over the world, Berry Global continues to invest in its business in the segments of healthcare, hygiene and specialty products in order to develop and maintain its production with a focus on key growing markets and regions where the company sees additional opportunities.

The company has installed a second line for the production of nonwovens by spinning from melt for the production of materials for hygienic and medical use in China shortly after the completion of the commissioning of the first Reicofil 5 line at the facility. China is still considered a growing market for Berry. In 2020–2021 Berry increased the production of nonwovens of the type spunmelt in the USA.

Fibertex Personal Care

Fibertex Personal Care, Aalborg, Denmark, recently invested $40 million to install new lines at its facilities in Malaysia and the USA. The Malaysian facility was expanded by adding a line for the production of special nonwovens, and a printing line was installed at the American facility in Asheboro, North Carolina. Currently, Fibertex Personal Care operates six lines at two sites in Malaysia, with a capacity of about 125,000 tons, as well as three lines in Denmark.In addition to expansion, Fibertex Personal Care continues to pay special attention to sustainable development. At the end of 2020, the company announced a partnership with Sabic, a global leader in the chemical industry, to create a range of nonwovens using recycled high-purity plastic Sabic Trucircle. They have developed the first known range of nonwovens for the hygiene industry based on recycled plastic. The initiative is seen by the two partners as a crucial step towards a more sustainable supply chain and greater recyclability of nonwovens. The new material can be used as a universal solution that meets the requirements of the brand owner in terms of cleanliness and safety for consumers in the field of hygiene.

Fitesa

This year, Fitesa will launch production on two high-performance modern Reicofil 5 lines, one in Simpsonville, South Carolina, and the other at an unnamed location in Europe. Both investments are part of Fitesa's strategy to increase the production of softer and more environmentally friendly materials for the global hygiene products market. Both of them will be equipped for the production of high-loft and standard products using a variety of biologically based raw materials and cyclic raw materials, primarily for hygienic and medical applications.

In addition to these two lines, Fitesa is completing a comprehensive expansion program that was announced in November 2020, resulting in an increase in its global capacity of 55,000 tons. This investment includes the Reicofil multi-block line, production of which began last year in Cosmopolis, Brazil. Another component of this plan is aimed at modernization, in which Fitesa increases production volumes, upgrades assets and increases the flexibility of the current asset base. These efforts have brought in another 20,000 metric tons of capacity for spunmelt materials, which are equally distributed between the United States and Europe.

Gulsan

Investments in the Turkish Gulsan group continue. In October 2021, shortly after the completion of the installation of the Reicofil 5 line at its site in Korlu, Turkey, the company announced that it would install a second Reicofil 5 line in Turkey, which was scheduled to launch in June 2022, as well as a second line at its site near Cairo, Egypt, later in 2022. Both lines were supposed to be put into operation last year.

Gulsan has not released data on the capacity of the new lines, but reports that the investment will support its future growth in the industry and strengthen its position as one of the leading manufacturers of materials spunmelt, for the production of high-quality, ultralight nonwovens with a very complex design. The company uses its modern technologies to provide materials to its business partners in the production of baby diapers, medical supplies and health products in the EMEA region (Europe, Middle East and Africa).

Mitsui/Asahi

Mitsui Chemicals and Asahi Kasei, two leaders of the Japanese nonwovens industry, will merge their nonwovens manufacturing enterprises at the end of this year. According to the proposed plan, all Mitsui Chemicals nonwovens enterprises, with the exception of fibrillated polyolefin fiber SWP, will be integrated with the Asahi Kasei enterprise for the production of spunbond and cartridge filters. The company will be called Mitsui Chemicals Asahi Life Materials Co. and will be based in Tokyo, Japan. Mitsui will own just over 60% of the company.

The company's Japanese sites will include Mitsui's Sunrex subsidiary in Miyo, Japan, as well as the Nogoya Works plant in Aichi. Meanwhile, the Asahi Kasei plant in Moriyama will provide its own production. The overseas sites include operations of both companies in Thailand, which will continue production and sale as subsidiaries of the newly formed integrated company. The production of Asahi Kasei spunbond in Moriyama will be joined to the company later through a merger by type of takeover.

PFNonwovens

The last PFNonwovens line, the Reicofil 5 line, was launched in the summer of 2022 in Pennsylvania. In addition, another line was launched around the same time in Cape Town, South Africa. These new lines have increased the company's global capacity by 10%.

From a technological point of view, PFNonwovens, which also has facilities in the Czech Republic and Egypt, commercializes one of the softest materials on the market, if not the softest material. The company also has highly efficient 100% bio-based canvases that help it follow the concept of sustainable development and are fully commercially available on the R5 platform. In recent years, PFNonwovens has installed at least one RF5 line on each continent. This allows the company to remain at the forefront of the most efficient and most competitive materials and technological developments.

Saudi German Nonwovens

The Saudi-German nonwovens manufacturing Company (SGN) is investing in a new production line Reicofil 5, focused on the production of environmentally friendly premium products, at its facility in Saudi Arabia. Thanks to the investment in the new R5 line, SGN will provide additional capacity to meet the market demand for eco-friendly and premium products worldwide. Currently, SGN has a significant presence in the baby diapers, adult incontinence and feminine hygiene markets and maintains long-standing partnerships with multinational brands in North America, Europe and regionally. In addition, the company operates several distribution centers in Europe and North America that localize the supply points of these new materials, providing flexibility and meeting local demand.

The new Reicofil 5 (RF5) line will add its production capacity and technological capabilities to the company's current production capabilities, which include four Reicofil lines. The investment will ensure the production of biocomponent and high-loft materials, complementing the current SGN range with premium products.

Toray

Toray produces 231,000 tons of nonwovens in Asia. The largest percentage of products are currently produced in China, where the company has two plants in Nantong and Foshan, which together produce 93,000 tons of nonwovens per year. The company's latest Chinese investment in Foshan was recently completed, resulting in an increase in capacity of 20,000 tons. This investment represents Toray's latest expansion in China, where demand for materials is still growing due to the growth of the hygiene products market. Also in 2020, Toray launched a production line at a site in India capable of producing 18,000 tons of material per year.

One of the largest manufacturers of nonwovens in Asia, Toray also produces 61,000 tons of material in Korea, 37,000 tons per year in Indonesia and 10,000 tons of nonwovens in Japan.

Union Industries

Union Industries' new investments include the spunmelt Reicofil 5 line in Italy. The line, commissioned at the end of 2021, allows the company, in addition to existing assets, to continue to produce both special and marketable materials for the hygiene market. Union has operating sites in Italy and Poland.