Publications

Last

Advertisement

Partners

Smithers: about the world market of nonwoven napkins

The market of nonwoven napkins in 2022 will reach $20.82 billion

According to the latest forecasts of the analytical agency Smithers, despite existing concerns about environmental friendliness and washability, global demand for non-woven consumer and industrial wipes will remain optimistic over the next five years.

Exclusive data available now in the Smithers report "The Future of nonwoven napkins until 2027" shows that the market in 2022 will reach a value of $20.82 billion, which is equivalent to 1.5 million tons of nonwovens. In 2022, the market remains optimistic and follows the previous two years of an unprecedented surge in demand related to Covid-19. Although the latest Covid strains are less deadly, they are still widespread. For example, China restored mass restrictions in the first half of 2022. Such measures support additional purchases of disinfectants and medical wipes - during 2022 and beyond.

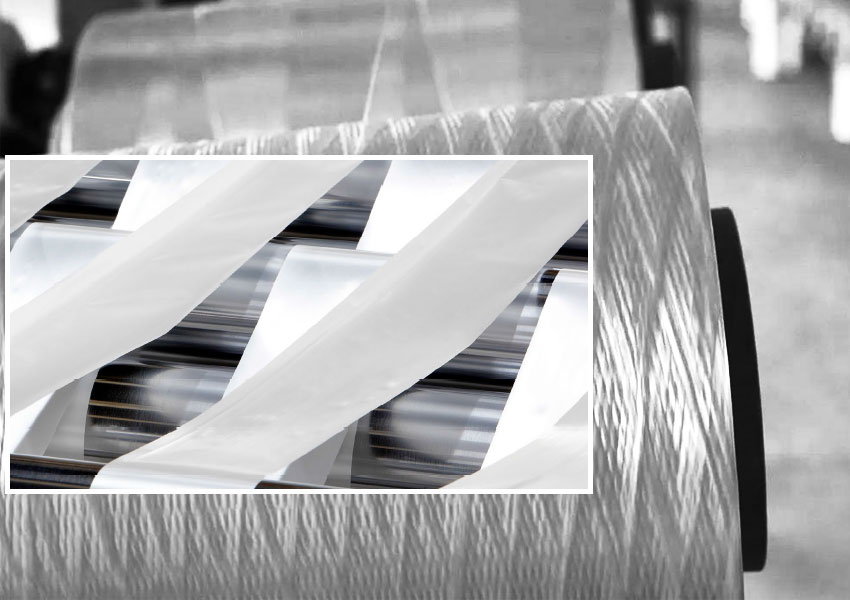

In the early days of the pandemic, many new lines for the production of non-woven napkins were ordered, and the governments of several countries identified these production lines, along with the meltblown lines, as their strategic and economic assets. The new lines will continue to be installed everywhere throughout 2022-2023, eliminating any residual effect of the shortage of supplies of necessary nonwovens and napkins observed in 2020.

The market will grow at an average annual growth rate (CAGR) of 6.8% in value terms and 7.4% in tonnage in the period from 2022 to 2027. By 2027, the market will have a value of $29.85 billion and consume 2.14 million tons of nonwovens. Over the same period, the total area of nonwovens used in napkins will increase from 27.55 billion square meters to 41.63 billion square meters.

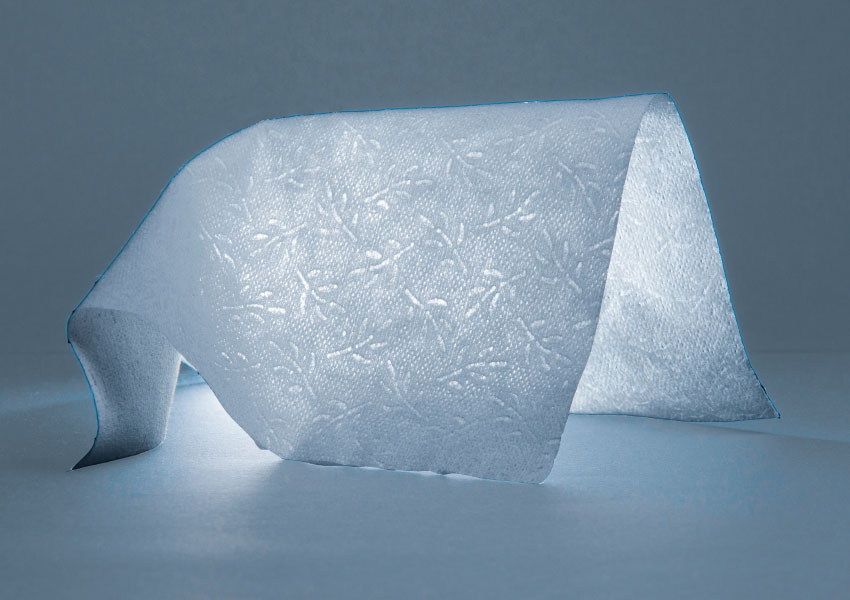

The leading market trend will be to increase the environmental friendliness of napkins, meeting both consumer expectations and new regulatory requirements. The EU Directive on the use of disposable plastics includes the creation of new labeling, consumer education and obligations to pay for the disposal of personal hygiene items and household napkins used by the consumer (industrial napkins are not considered).

In general, "spanlace" will remain the dominant technology for the production of nonwovens for napkins, but sustainability issues are stimulating research and development in the field of improvements, including the use of more wood fibers and, possibly, bioplastics based on polyhydroxyalkanoates (PHA). Also, the demand for other innovations will be stimulated, including the integration of modified binders based on carboxymethyl cellulose into various airlaids and the transition of napkin manufacturers to modified hydro-mixed wetlaids (spunlaced wetlaid).

The flushability of wipes remains and will continue to be in trend, as well as the development of wipes for cleaning sewer systems, and not for their contamination. Several US states, including Illinois, Oregon and Washington, have now passed laws regarding the "washability" of wipes as a mandatory characteristic of them.

The strongest growth during the forecast period will be in the segment of personal care wipes, followed by the segment of household consumer wipes. Demand will grow fastest for wet adult toilet paper and cosmetic wipes/face wipes over the next five years. In the hygiene and household use segments, double-digit growth will be maintained over the next five years, along with an increase in the use of more environmentally friendly nonwovens. The demand for industrial wipes will be closely linked to the overall recovery of production, and the growth of the production of baby wipes will be the slowest.

In the report Smithers presents exclusive datasets segmenting the market by:

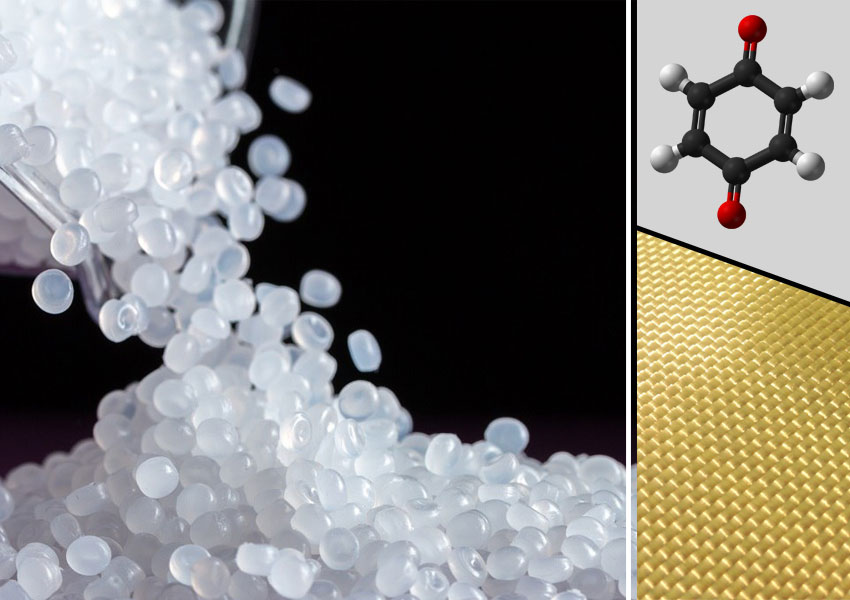

- raw materials: cellulose, viscose/lyocell, cotton, polypropylene fiber, polypropylene polymer, PET, bi-fiber, binder STD, binder SPEC, PLA, etc.;

- the process of forming the canvas: spanlace, airlade, needle-punched, coform, spanlade, vetlade, carding, etc.;

- end use: child care, wet toilet paper for adults, infant care, adult urinary incontinence, cosmetics/facial care, feminine hygiene, other personal hygiene, cleaning/disinfectant, wet floors, electrostatics, furniture/glass, cars, other household goods, general industrial purpose, special industrial purpose, catering, healthcare;

- by geographical regions/national markets (Asia, China, India, Japan; North America; South America; Western Europe, Benelux, France, Germany, Italy, Scandinavia, Spain, UK; Eastern Europe, Russia, Poland, Turkey; rest of the world.