Publications

Last

Advertisement

Partners

Smithers - The future of Spunlace nonwovens until 2026

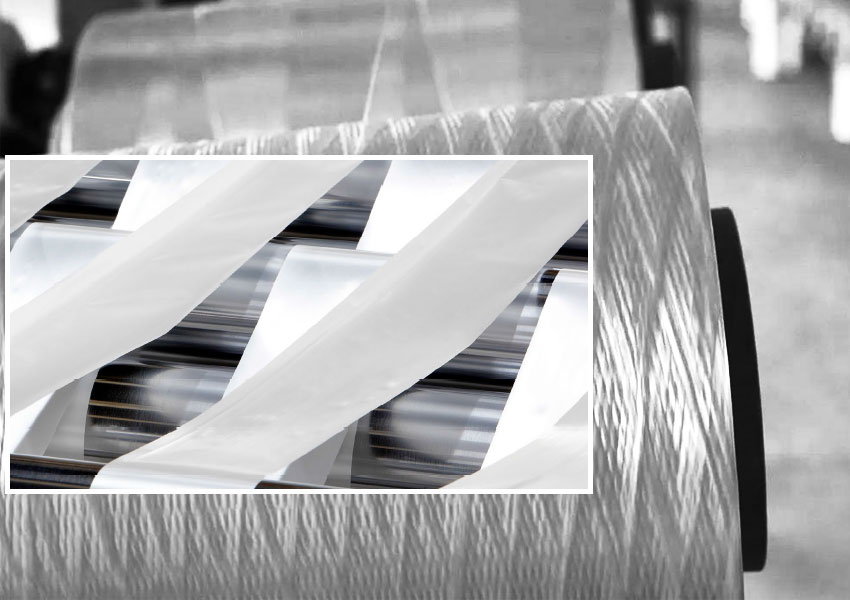

The global spunlace nonwovens market reached $7.8 billion in 2021 as new napkin production lines were added in response to the surge in demand for them caused by COVID-19. This has led to an increase in installed capacity to 2.62 million tons in 2021, according to the latest Smithers expert study in this market segment.

The analysis of the study published today shows that increased concern about infection control will help spunlace production to withstand any recessionary downturn with an impressive forecast of 9.1% cumulative annual growth (CAGR) for 2021–2026. This will increase the total market value to $12.04 billion in 2026.

The Smithers report shows that over the same period, the total tonnage of spunlace nonwovens will grow from 1.65 million tons (2021) to 2.38 million tons (2026). While the production volume of spunlace nonwovens will grow from 39.57 billion square meters (2021) to 62.49 billion square meters (2026), which is equivalent to an average annual growth rate of 9.6%, as manufacturers focus on the production of lighter nonwovens.

Most of the growth will come from Asia, with China alone going to install about 50 new lines in 2021-2022. During the same period of time, it is planned to build up to 30 new lines for the production of spanlace-type materials in Turkey.

During the forecast period, card-card (CC) will remain the dominant web forming process for spunlace technology. In 2021, its market share by volume was 75.6%, and this share will not decrease significantly in the future. Over the next five years, the demand for wet-stacked spunlace (WLS) will grow, while the market shares of the spunlace variants "card/cellulose/card" (CPC) and spunbond/cellulose (SP) will decrease. The challenges of sustainable development will lead to the fact that the nascent card/airlade/card (CAC) technology will have the highest growth rates, and the global consumption of such hydro-mixed material will increase more than fourfold by 2026.

Napkins (children's, home, industrial, personal hygiene products) account for about 64.7% of all applications of spanlace materials produced in 2021. By 2026, the highest growth rates of the production of napkins for personal hygiene, as well as wet toilet wipes for adults and toddlers are predicted. Demand for durable goods will be more subdued; although there will be new market opportunities in the field of consumer hygiene, as spanlace represents a sustainable alternative to competing polyester or polypropylene-based nonwovens in areas such as ultra-thin top-sheets for feminine sanitary pads.

As the imminent threat of COVID recedes, the leading trend for transformation in the first half of the 2020s will be the development of more sustainable nonwovens. As a rule, this is beneficial to spanlace manufacturers, since they are working on creating napkins that completely lack plastic. The main way to achieve this is the wider use of viscose, lyocell, cellulose, cotton and other biodegradable fibers with a corresponding relative reduction in the use of polypropylene or polyester fibers.