Publications

Last

Advertisement

Partners

Meltblown - what is the reason for the global growth of production capacity

At the beginning of the spread of the COVID-19 pandemic during the period of early 2020 - mid-2021, at least 150 new lines for the production of non-woven fabric of the Meltblown type were installed in the world.

This material is used as the main barrier layer of the SIZOD, which prevents the penetration of harmful particles (bacteria, viruses, dust, pollen, toxic aerosols) into human respiratory organs. The Meltblown material was known long before the pandemic.

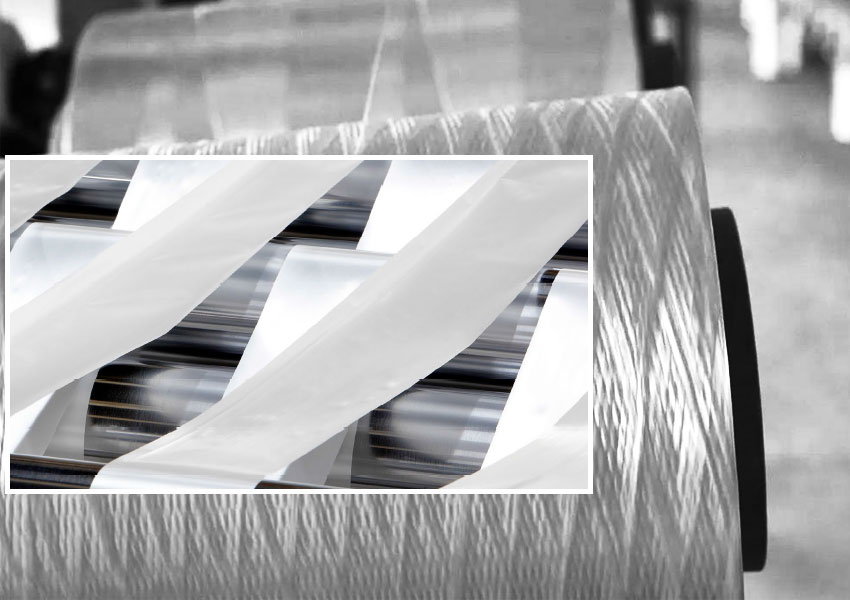

The technology of blowing molten polymer using heated air from a flat-gel die onto a cooling drum or conveyor belt was used to produce materials for the following applications:

- sound insulation

- interior decoration of transport and premises

- absorption of fuels and lubricants and petroleum products from various surfaces

- air purification in ventilation and air conditioning systems (industrial HEPA, ULPA filters)

- aerosol filtration (respirators)

- filtration of liquids, including human biological fluids (filters for hemodialysis)

- medicine and hygiene (barrier layer in composite nonwovens of SM…S type, filter layer in medical and surgical masks)

Despite the many fields of application, there was no excitement and boom about this material in the pre-war years, which was explained by its highly specialized application and the lack of need for its daily use by every inhabitant of the planet in an amount equal to approximately 1 m2.

In order to understand the scale of the glut of the meltblown market in 2021, let's turn to the sales statistics of only one German company - the world leader in polymer extrusion Reicofil (Reifenhauser Group), specializing in the manufacture of equipment for the production of nonwovens and films. If for the whole of 2019 the company sold only 2 meltblown production lines, then starting from the second quarter of 2020 Reicofil provided its customers with similar lines weekly, offering single and double-beam configurations with a width of 1.6 m and 3.2 m.

The global growth of production capacity was based on completely different concepts. If some deliberately installed equipment from renowned manufacturers (Reicofil, Hongda Research Institute, Oerlikon Nonwoven, CL Nonwovens, Ramina, Shaoyang Textile Machinery) in order to meet national needs for high-quality filter material (for FFP2, FFP3 class products) and in subsequent years, others, in pursuit of quick profit, manufactured equipment independently or purchased it from "no-reference" rdquo; manufacturers, realizing in advance that this hardware will not be able to provide high quality material. Such companies tried to obtain the necessary indicators of the filtering ability of meltblown exclusively by means of electret additives introduced into the main polymer and subsequent electret processing of the canvas.

Both concepts fully justified themselves in the short term, especially against the background of the fact that at the beginning of the pandemic, many, even state-owned companies, taking advantage of the ignorance of the population, offered for sale as SIZOD face bandages from various textiles sewn on simple sewing equipment, or masks made on maskmaking machines from three layers of available spunbond.

Equipment for the production of meltblown from manufacturers (mainly the PRC), unknown before the pandemic, despite the maximum six-month operational resource embedded in it, still had some positive aspects in addition to the speed of manufacturing such equipment. It used the main technological units, which could not be produced by most of the newly appeared companies independently due to the complexity of their design and the peculiarities of their manufacture from special alloys on high-precision equipment. We are talking about die sets. Therefore, even these companies were forced to literally "queue" for die sets to such well-known engineering companies as Enca Tecnica, JCTimes and Kasen.

Taking advantage of the unprecedented market demand for meltblown, companies that purchased lines from little-known manufacturers and quickly put them into operation, recouped their investments many times even before the operational resource of these lines was exhausted, given the fact that at the height of the pandemic, the cost of meltblown reached $ 60 per kilogram. In most cases, such lines were used to the maximum, stopped, disassembled and scrapped after the initial excitement at the SIZOD subsided and people began to pay attention to the properties and quality characteristics of the final products, as well as their compliance with international standards (EN14683, EN149, YY0469-2011, GB2626-2006), confirmed by independent certified laboratories.

Now it's time to mention the companies that have acquired and currently continue to invest in meltblown nonwoven fabric production equipment not in pursuit of short-term profit, but providing the necessary high-quality material to the population of their (and not only) countries in the long term.

- Firstly, by investing in equipment of well-known brands, such meltblown manufacturers received technological lines designed for high productivity and long-term operation.

- Secondly, such machine builders provided their customers not only with high-quality iron, but also provided technological support, including the recommendation of the raw material base and the selection of technological modes to obtain a product that meets industry standards, as well as after-sales service.

- Third, for the most part, future meltblown manufacturers ordered lines designed not only for the production of materials of the traditional range of surface densities of 20-80 g/m2. When carefully working out projects for investing their investments, the equipment customers in their technical requirements provided for the presence of several beams in the lines (which of course positively affected the performance of the lines and the quality of the canvas), as well as the use of both single-row and multi-row dies (up to 18 rows at Reifenhauser Reicofil) for the production of highly elastic materials, as well as materials of high surface densities (up to 500 g/m2) with exceptional absorbent properties.

- Fourth, another feature of the installed lines was the availability of processing options in them, along with polypropylene (PP), and other polymers: PE, PET, PLA, TPEE, PA, TPU - which significantly expands the range of meltblown applications and ensures stable employment of the line in the production of material for alternative segments in case of saturation of the PP market with meltblown for use in SIZOD.

The pattern of the whole observed situation is that the leaders of the hygienic and medical products industry (Berry Global, PFN, Kimberly Clark, P&G, Freudenberg, Gulsan, Avgol, Mogul, Fitesa, etc.) invested in the leaders of the mechanical engineering industry (Reifenhouser Reicofil, Hongda Research Institute, Oerlikon Nonwoven, Ramina). The same companies that had never produced meltblown before mostly preferred to invest in more budget lines from machine builders who had no experience in this field and, accordingly, references to successfully implemented similar projects in their business history.