Publications

Last

Advertisement

Partners

Marketing research on Meltblown nonwoven fabric from Smithers: how much demand has increased

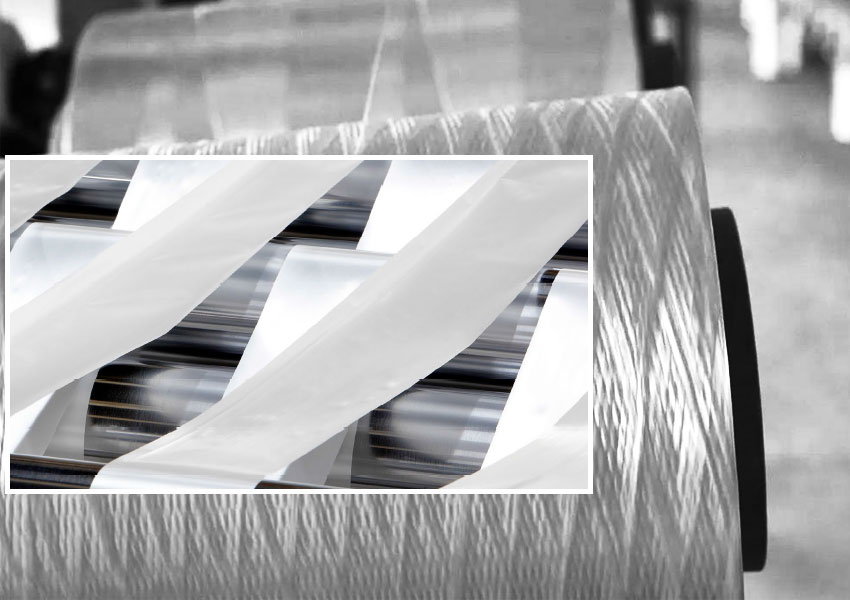

Smithers publishes marketing research on Meltblown nonwoven fabric

Sales of meltblown-type nonwovens doubled to US$ 1.68 billion due to increased sales of SIZOD and disposable medical devices.

The global market of meltblown nonwovens has changed radically due to Covid-19. Demand for vital products such as face masks and medical PPE has grown from $809 million in 2019 to $1.68 billion in 2020.

Since this process has become a major problem for manufacturers and processors of nonwovens, it is described in detail in a new special study Smithers - "The future of meltblown nonwovens until 2026". It provides detailed meltblown market data (by tonnage, surface area, cost of raw materials and cost of sales), reflecting the radical changes that have characterized the market since the beginning of 2020.

In the early days of the pandemic, professional and medical PPE - especially N95 medical face masks - became a vital commodity.

Smithers data shows that demand has increased almost 10-fold from 14,400 tons in 2019 to 121,800 tons in 2020, while other medical uses associated with meltblown have increased fivefold. This led to the fact that the world's production capacity for meltblown was working at the limit; and manufacturers of related products, such as SMS, switched exclusively to the production of meltblown. Many new lines have been put into operation around the world to increase production capacity and ensure the availability of material within the country.

The reduction of the Covid threat in the second half of 2021 led to a slight drop in the meltblown market after this unprecedented peak. Residual concerns about Covid and the need to create strategic reserves in case of similar outbreaks in the future mean that demand will remain well above pre-pandemic levels until 2026. In total, 302,700 tons, or 5.07 billion square meters of material, will be sold in 2021, with a selling value of 1.17 billion US dollars.

This experience has led to serious, albeit temporary, shifts in the meltblown markets.

The importance of materials for face masks led to the fact that meltblown with elementary fibers less than 4 microns was in demand on the market to a much greater extent than standard meltblown with a filament thickness of 4-15 microns. The share of disposable products using meltblown increased from 40% in 2019 to 64.6% of total consumption in 2020. By 2026, the production of reusable and single-use goods using meltblown in their design is projected to increase.

New melt blowing production lines were built and put into operation in record time during the pandemic. As the demand for face masks declines in the coming years, the market will face an excess of meltblown production capacity - up to 77% of these new capacities will be unusable in the long term. This will lead to lower prices for meltblown in case of stabilization of polypropylene prices and the closure of some old lines. Government support of local producers and processors of meltblown for PPE as a strategic resource will not eliminate the need to search and develop new areas of application of this non-woven material.

Another factor that will manifest itself over a five-year period is the increasing impact of sustainable development policies on the nonwovens industry.

Due to the specific performance requirements of meltblown, its manufacturers will continue to rely more on polymer raw materials, especially polypropylene. It accounts for 91% of the materials produced using meltblown technology in 2021, and only a small proportion for other types of polymers. In the period from 2021 to 2026, there is potential for the integration of biologically based polymers, including some other biodegradable varieties. Other advances in waste reduction, lower base weight materials, and the use of recycled polymers are also possible. These trends will not have a big impact on meltblown-type nonwovens until 2026. It will continue to be determined, to a greater extent, solely by characteristics.

Growth rates for 2021–2026 are projected at 3.5% (tons), 6.1% (m2) and 6.4% ($). This is an expected market correction.